Jaker Chen

Jaker Chen  April 09,2022

April 09,2022

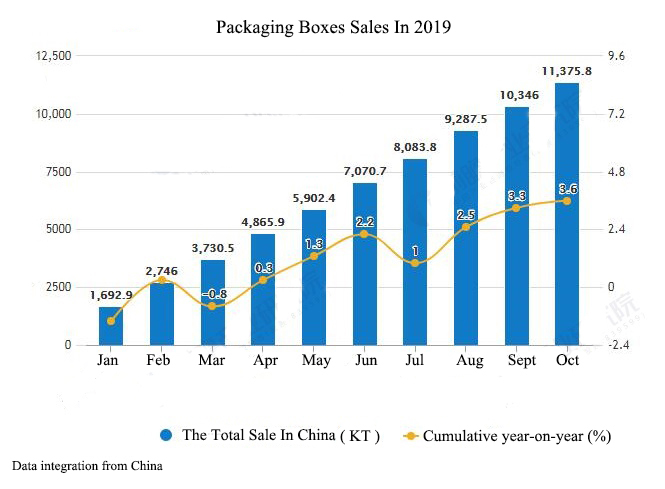

Due to the global transmission of the new coronavirus, it has caused certain impacts on industries in various countries, and the impact on the printing industry has fluctuated fairly smoothly. It is believed that with the joint efforts of the peoples of the world, the new coronavirus will have nothing to do, and will allow the world's economic development to return to normal. As the application fields of corrugated boxes and non-corrugated boxes become more and more extensive, global businesses have more and more demands for the printing industry. Only suppliers with outstanding design and quality can achieve better development in the future.

1. The export volume of electronic packaging boxes has increased significantly

Constant innovation and progress in the field of science and technology have been recognized and loved by the masses, so that sales of electronic products continue to rise. OPPO, VIVO, Huawei, Apple and other brand mobile phones will promote the export volume of the printing industry regardless of the improved function or appearance. China market The shipment volume of the wearable device market in the first quarter of 2019 was 19.50 million units, a year-on-year increase of 34.7%. Among them, basic wearable devices increased by 25.5% year-on-year, and smart wearable devices increased by 84.6% year-on-year (from China Report Network www.chyxx.com). It is worth mentioning that the popularity of TWS Bluetooth headsets has greatly affected the future trend of the packaging industry. In 2019, the export volume of TWS Bluetooth headsets nationwide packaging boxes reached 130 million sets, a year-on-year increase of 52.8%. It is expected that the export volume of electronic packaging boxes will continue to increase in 2020, especially mobile phone packaging boxes and Bluetooth packaging boxes.

2. The unit price of daily necessities is picking up

On June 24, 2018, the State Council of China announced the "Opinions of the Central Committee of the Communist Party of China on Strengthening Ecological Environmental Protection Resolutely Fighting against Pollution and Combatting Pollution", and proposed that "the prevention and control of pollution by solid wastes be strengthened." Comprehensively prohibit the entry of foreign garbage, severely crack down on smuggling, substantially reduce the types and quantity of solid waste imports, and strive to basically achieve zero imports of solid waste by the end of 2020. This clear target will cause the comprehensive gross profit level of the papermaking sector to continue to increase in 2020, an increase of about 4.81pct year-on-year. However, affected by the global outbreak of new coronaviruses, the foreign economic chain was on the verge of collapse in the first two quarters of 2020. Demand for low-cost, high-frequency, and irreplaceable boxes of daily necessities starting from June 2020 is expected to increase sharply. At the same time, in order to cope with the tightening of domestic waste materials in line with the policies of the State Council of China, the unit price of packaging boxes has to be significantly increased.

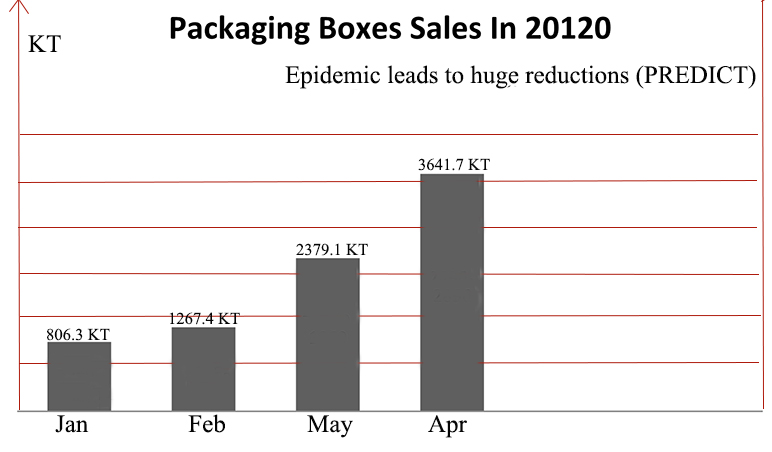

3.Alcoholic packaging box cuts

Since January 2020, all Chinese citizens have banned dining and entertainment, and most of China's entertainment-related industries are on the verge of bankruptcy. According to the past, the entertainment-related industries have made the most profits during the Spring Festival. The outbreak of the epidemic has extended the inventory time infinitely and also affected the packaging industry. The outbreak of new coronaviruses in European countries in March 2020 further hit the export volume of the wine industry. Foreign wine import demand is decreasing, domestic liquor and wine export are also decreasing. The combination of the two basically determines the order of wine packaging boxes in the first two quarters of 2020.

4. Pulp prices have stabilized in the short term. There is not much new capacity for broadleaf pulp in the next 4 years, and there is a basis for pulp prices to recover.

In the short term, pulp prices have stabilized, and port inventory has begun to decline. In September, the inventory days of international wood pulp ports were 44 days, a decrease of 4 days month-on-month, and the inventory volume decreased by 0.48% month-on-month. In October, the inventory fell by 5.29%. The global shipment of wood pulp was 4.75 million tons in September, a year-on-year increase of 3.17% and 4.03% respectively. Global wood pulp demand has picked up in the short term. Benefiting from this, the international pulp price began to stabilize in September this year, and the internal pulp price also basically stopped the downward trend in November. In the short term, the price of wood pulp has certain support, and the probability of continued decline is small.

In the next 4 years, there will not be much new capacity for broad-leaf pulp, and there is a basis for pulp price recovery. According to PPPC statistics, the global supply of broadleaf pulp is expected to be 39.57 million tons this year, a slight increase of 0.51% year-on-year, and the demand is 33.32 million tons, a year-on-year increase of 0.95%. In the next 4 years, it is estimated that the global new-leaf pulp production capacity will be 2.91 million tons, and the new demand will be 3.91 million tons. On the other hand, according to Bloomberg statistics, it is estimated that the global new wood pulp production capacity will be only 1.3 million tons next year. Taken together, there is not much new global wood pulp production capacity in the future, and to a certain extent, demand growth is faster than capacity growth. Therefore, in the medium and long term, the price of wood pulp has a basis for a mild rise.

5. Cosmetic boxes, gift boxes and jewelry boxes declined slightly in the first three quarters

The most effective and popular sales channel for the first two quarters of 2020 is live broadcast sales. The time for people to go out for dinner and entertainment has almost halved compared to 2019, and most of the time they have to rest at home, which provides a lot of space for the live broadcast industry. However, live agent sales are only B2C, and the target customer group is only offline, and the single order volume is not high. If products such as cosmetics, gifts and jewellery are obtained mainly through this method, sales are expected to decrease by 11.3% year-on-year in 2019.